Salève Energy Partners have worked on many different types of acquisitions and divestments

corporate and assets deals

within country or cross-borders

transaction values from several million to multi billion

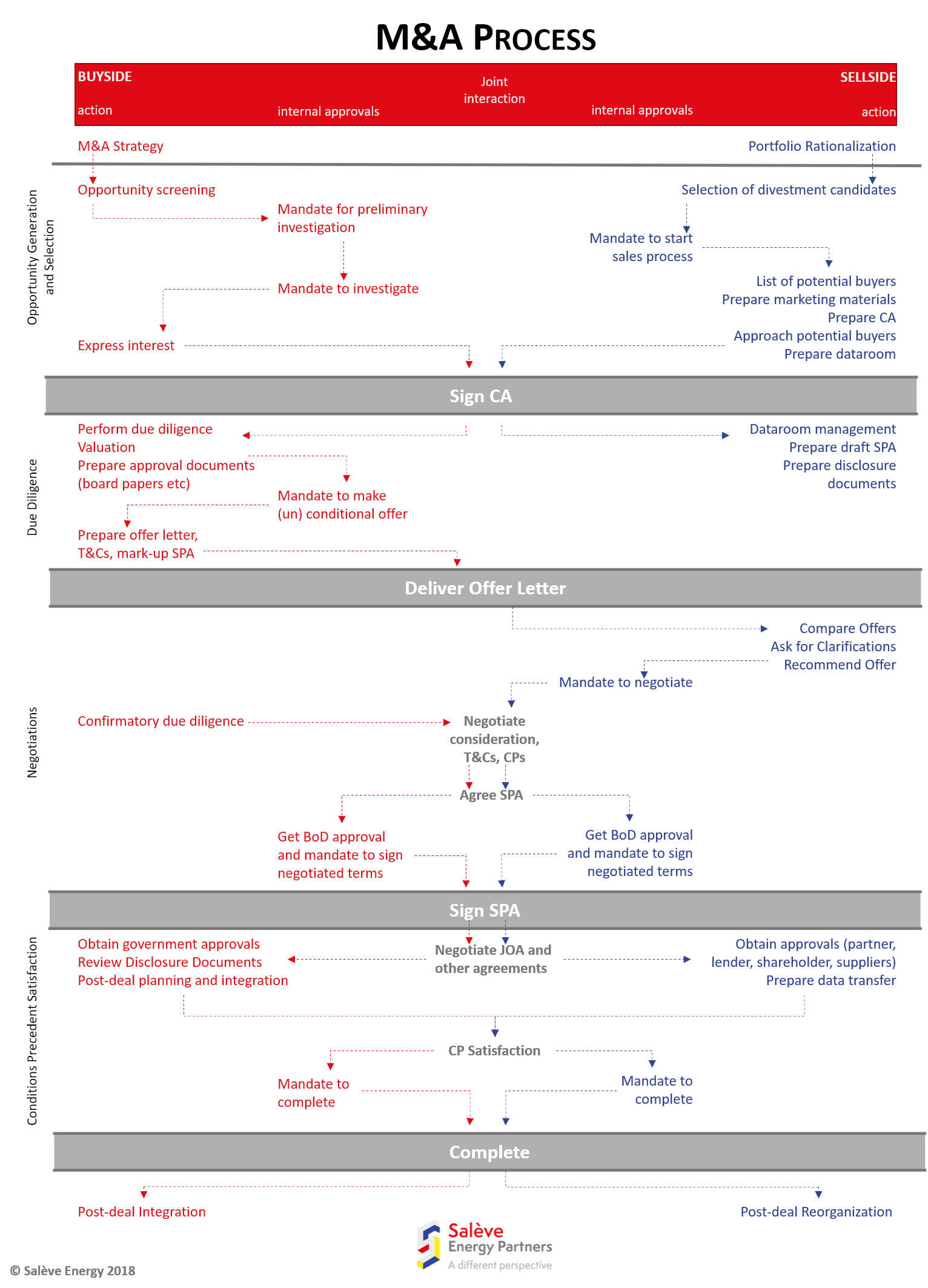

Salève Energy Partners offers its expertise in full spectrum of the opportunity funnel of the M&A process:

Please click here for a high resolution file of the M&A process above, which can be best printed on A3 paper

Opportunity Funnel

researching, analyzing and summarizing numerous, corporate and asset, acquisition targets,

generating opportunities

preparing of investment recommendations and seeking senior management approval

preparing teasers and information memoranda,

attending data rooms and performing due diligence

seeking final approval from senior management to proceed and writing Board Papers,

preparing term sheets, offer letters and sale and purchase agreements,

negotiating agreements to completion

preparation of completion statements.

Specific expertise in Mergers, Acquisition and Divestment:

Testing opportunities against company strategy

Leading multi-cultural, multi-disciplinary (commercial, finance, economics, legal, technical, operations) due diligence teams

Data room attendance and commercial due diligence including summarising and comparing commercial terms and identifying how agreements fit together

(Commercial) risk analysis

Preparation and hosting of Seller’s data room (real or virtual)

Summary and comparison of advisor offer letters

Preparation of flyers/teasers and information memoranda (IM) – ensuring they are sales documents

Comparison of advisor’s offer letters and advising senior management on the best choice.

Identification and summary of the commercial aspects of agreements and advise how these should be included in valuations

Analysis on strategic impact of a farm-in, acquisition, divestment or merger

Independent review of takeover offers

Tactics around pre-emption

Negotiations of

Confidentiality Agreements (CA),

Production Sharing Contracts (PSC)

Risk Service Contracts (RSC)

Licence Applications

Concession Agreements

Joint Operating Agreements (JOA) and Accounting Procedures,

Unit Operating Agreements(UOA)

Engagement Letters (with financial or legal advisors)

Farm-in Agreements

Sale and Purchase Agreements